B.Com Taxation

B.Com Taxation is a three-year full-time undergraduate curriculum that studies bookkeeping, financial planning, and economic hypotheses, with a concentration on tax assessment. This course is intended to help students prepare for technical training in taxation, accounting, and finance. The B.Com Taxation programme is designed for students who are interested in commerce and wish to pursue a career in accounting or finance. Students can work as tax consultants, tax experts, senior tax managers, tax compliance managers, cost estimators, lecturers, financial analysts, and more after completing the course.

About B.Com Taxation

The Bachelor of Commerce in Taxation is an undergraduate degree that teaches students about many aspects of accounting, bookkeeping, and finance, with a particular emphasis on taxation. Students with a B.Com in Taxation gain specialized knowledge of accountancy, finance, taxation, and microeconomics in business. “Taxation can be defined as a phrase for when a taxation authority, usually a government, levies or imposes a financial obligation on its people or residents of paying the tax,” according to Investopedia. This course is designed to cover all of the fundamentals of income tax, GST, and corporate tax.

Eligibility Criteria for B.Com Taxation

Only those students who meet the qualifying requirements are admitted to the B.Com Taxation programme. Students must pass the 10+2 or any other equivalent examination from a recognized board with a minimum of 50% in order to be eligible for B.Com Taxation. Furthermore, students must have studied any of the following subjects in 10+2: commerce, science, or arts. Students must be under the age of 25. Students must also pass the college entrance tests in order to be considered for admission.

How To Get Admission in B.Com Taxation?

Students must meet the eligibility requirements in order to pursue a B.Com in Taxation. For merit-based admissions, students must have good grades in 10th and 12th grades, as well as strong performance in entrance exams for entrance exam-based admissions. Admissions to the B.Com Taxation programme can be made in either direction. While some colleges offer merit-based admissions, others require applicants to take entrance exams. Admissions applications are available on the University website as well as at the Admissions Office of the college. The following are the specifics of the admissions process:

How to Apply?

Admissions information for the B.Com Taxation programme can be obtained on the official websites of the colleges to which students wish to apply. Online and offline methods are both available for registering for admission. For offline admissions, students must come to the college campus, fill out an application form, pick up a brochure, and submit all required documents. Students who wish to apply online should go to the college’s admissions website and fill out the application form. The application fees can be paid using an online money transfer or by sending a bank check or demand draught. Students will get further correspondence from the college after submitting the application form.

Selection Process

12th Standard (Commerce/Science) Minimum 50% marks for General (SC/ST – 40%) (OBC- 45%)

Students can apply online on the official website of LNCT University.

Why Choose B.Com in Taxation?

Before deciding on a course, students frequently inquire about the specifics of B.Com in Taxation. Students should ask themselves, “What is B.Com in Taxation?” and “Why select B.Com in Taxation?” before deciding on a vocation. We posed the following three questions in order to find answers to these concerns:

What is B.Com Taxation All About?

Students in the B.Com with Taxation programme learn about applying taxes, assessing monetary arrangements, and summarising transactions throughout the course of three years. The course is designed to prepare students for careers in finance, accounting, and taxation. In addition, students will benefit from this course as they learn about many areas of trade and taxation systems. The Indian Tax System, Financial Accounting, Business Organization, Income Tax Procedures and Practices, and so on are all covered in the B.Com in Taxation programme. Students can easily become Financial Risk Managers, Tax Consultants, Tax Specialists, Senior Tax Managers, Tax Compliance Managers, Lecturers, Stockbrokers, and Financial Analysts after completing the course.

What Does a B.Com Taxation Graduate Do?

Graduates of B.Com Taxation have a wide range of job choices in both private and public enterprises. The demand for taxation graduates is growing in today’s economy, and talented graduates have plenty of options. Students who earn a B.Com in Taxation can work in a variety of fields, including business consulting, inventory control, marketing, educational institutes, budget planning, and so on. Students can also pursue advanced studies in M.Com or other relevant degrees to gain a deeper understanding of related business and taxes topics.

Tax Specialists are in charge of federal and international tax compliance on a quarterly and annual basis. They help with IRS and state audits, as well as researching tax laws and ensuring that tax returns are submitted correctly.

Why Can a B.Com Taxation Degree Get You a Valuable Job?

For those who are passionate about business and taxation, B.Com Taxation can be a highly successful and gratifying career. Tax professionals are crucial in ensuring that businesses run effectively and that taxes are filed on schedule. Taxation positions pay well, and incomes rise as you gain experience and skill. Furthermore, a B.Com Taxation degree might lead to more lucrative opportunities. This training opens up numerous job opportunities in consulting, BPO, banking, auditing and tax services, financial services, and other fields.

According to an Economic Times study, the new GST tax regime has created a demand for 1.3 million experts. This indicates the ever-increasing need for tax experts. Graduates with in-depth tax knowledge and strong analytical skills are in high demand in the sector. As a result, tax graduates have numerous career options in the business world.

Tips for B.Com Taxation Preparation

B.Com in Taxation is a promising professional path, but students should be well prepared before enrolling. The following are some helpful hints for those interested in pursuing a B.Com in Taxation:

Regular practise will help you to improve your knowledge of commerce and taxation.

Examine the Course: Conduct a thorough examination of the course and select the best career option for you.

Improve Your Skills: Improve your analytical and logical skills and master new subjects to take advantage of the best opportunities and perform well throughout the course.

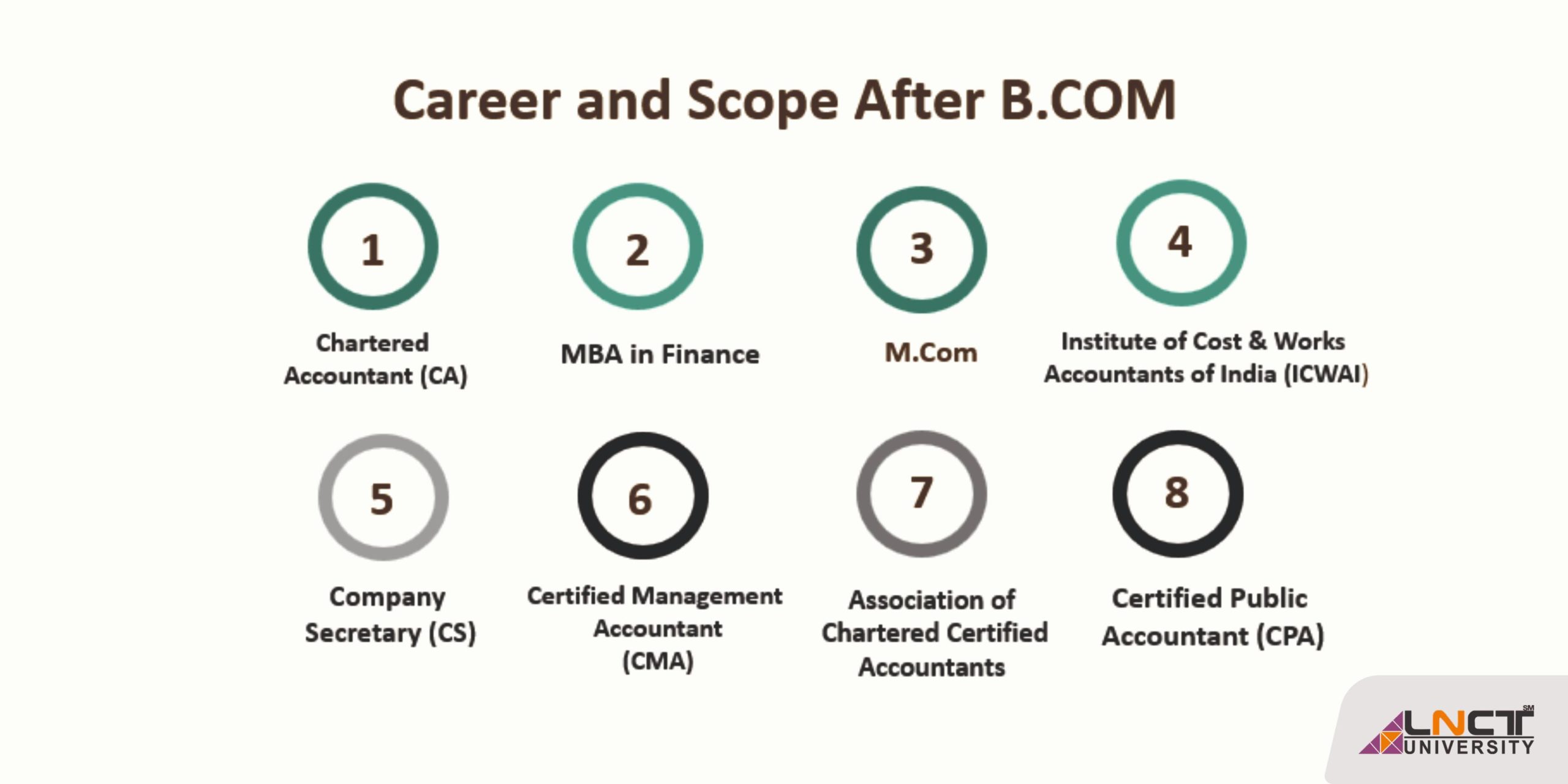

Higher Education’s Scope

B.Com Taxation graduates have a wide range of prospects and professional options. Depending on their talents and interests, students might choose between a job and further education. B.Com Taxation opens doors in a variety of fields, including marketing, overseas commerce, and public accounting. Following completion of the programme, students can enrol in the following higher education courses:

M.Com

MBA

CA

B.Com Taxation Graduate Salary

Graduates of the B.Com Taxation programme can work in the fields of accounting, finance, and taxation. This course provides students with numerous work and higher education opportunities. Students who hold a B.Com Taxation degree can work as chartered accountants, financial risk managers, tax consultants, tax specialists, senior tax managers, tax compliance managers, cost estimators, lecturers, stockbrokers, financial analysts, and actuaries, among other positions. Graduates can also find work in both the private and public sectors. The average income for B.Com Taxation freshers is INR 2 – 4.5 LPA (PayScale), with experience and skills increasing with time.

Taxation Career Options After a B.Com

Companies and individuals alike desire to save money and avoid tax penalties. This is where tax professionals come to our aid and assist us with all of the paperwork and tax filing. For B.Com Taxation graduates, there are a variety of work opportunities in both public and private enterprises. Students can work in a variety of settings, including Business Consultancies/Agencies, Educational Institutions, Industrial Houses, Public Accounting Firms, Policy Planning, Foreign Trade, Banks, Budget Planning, Inventory Control, Merchant Banking, Marketing, and so on. Students can also pursue post-secondary education or other professional credential programmes. Graduates can choose from a variety of job opportunities, including:

- Chartered Accountant

- Financial Risk Manager

- Tax Consultant

- Tax Specialist

- Senior Tax Manager

- Tax Compliance Manager

- Cost Estimators

- Lecturer

- Financial Analyst

Semester Wise B.Com Taxation Syllabus

The B.Com Taxation curriculum focuses on accounting fundamentals, financial planning, and economic theory, with a concentration on taxation. It introduces students to a wide range of principles in commerce and taxation, including all forms of taxes and accounting. The first year of B.Com Taxation courses primarily focuses on the introduction, whereas the second year of B.Com Taxation subjects stresses in-depth basic principles. The table below shows a semester-by-semester distribution of the syllabus:

| Semester I | Semester II |

| Indian Tax System | Indian Tax System(Cont.) |

| Income Tax Law Procedure | Financial Accounting |

| Fundamental Principles of Accounting | Partnership Accounting |

| Business Mathematics | Business Regulatory Framework |

| Indian Contract Act and Sale of Goods Act | Business Communications |

| Business Organization |

| Semester III | Semester IV |

| Income Tax Procedure & Practices | Income Tax Procedure & Practices(Cont.) |

| Wealth Tax & Vat Procedure and Practices | Advanced Statistics |

| Basics of Company Accounts | Wealth Tax & Vat Procedure and Practices |

| Theory and Practice of Cost | Advanced Corporate Accounts |

| Indian Company Act | Advance Cost Accounts |

| Principles of Statistics | Principles of Management |

| Semester V | Semester VI |

| Central Excise Procedure & Practice | Central Excise Procedure & Practice(Cont.) |

| Custom Procedure & Practice | Custom Procedure & Practice( Cont.) |

| Income Tax for Individuals | Income Tax for Business |

| Accounting for Managers | Indirect Tax |

| Financial Management | Auditing |

| Marketing Management | Human Resource Management |

Accounts and Finance departments of various corporations are the most common places to look for B.Com Taxation jobs. More and more students are choosing a degree in taxation as a means of establishing a successful profession. Students can easily find work as a Financial Risk Manager, Tax Consultant, Tax Specialist, Senior Tax Manager, Tax Compliance Manager, Lecturer, Stockbrokers, Financial Analyst, and other positions in a variety of private and government companies after completing the course. After completing a B.Com in Taxation, you can work in a range of industries such as the corporate sector, banking sector, Indian Economic Services, and so on. Graduates of the B.Com Taxation programme can continue their education with a Master of Commerce or other related degrees, expanding their expertise and boosting their average wage.

Career Prospects and Job Scope for B.Com Taxation

Accounts and Finance departments of various firms, banks, government agencies, educational institutions, and other private organizations are hiring B.Com Taxation graduates. B.Com Taxation jobs provide students with chances in a range of growing areas, including fintech, banking, income tax, marketing, and so on. During the course, students gain skills and knowledge in taxation and business, which prepares them for a variety of vocations. The scope of B.Com Taxation is not confined to a single industry, but rather covers a wide range of industries. The following are some of the best professional positions for B.Com Taxation freshers:

- Tax Policy Analyst

- Auditing Clerk

- Budget Analyst

- Accounts Assistant

- Tax Manager

- Cost Accountant

- Business Analyst

- Corporate Analyst

- Risk Analyst

- Tax Collector

- Employment Tax Specialist

- Tax Consultant

- Accountant

- Tax Examiner

- Equity Research Analyst

- Tax Attorney Specialist

- Revenue Agent

- Tax Advisor

- Bookkeeping Staff

- Tax Assistant

- Investment Banker

- Tax Recruiter

- Financial Analyst

Areas of Recruitment for B.Com Taxation Graduates

B.Com Taxation graduates can find work in a variety of industries, including accounting, finance, and banking. With the increased demand for taxation graduates, students have a wider selection of professional options. Taxation employment for B.Com graduates is available in a variety of businesses. The following are some of the areas where B.Com Taxation graduates can find work:

- State Sales Tax Laws

- Corporate Sectors

- Indian Economic Services

- Banking Sectors

- Research Firms

- Economic Consulting Offices

- Indian Civil Services

- Customs Departments

- Excise Departments

- Import/Export Companies

- Airports & Docks

Government Jobs for B.Com Taxation Graduates

The B.Com Taxation programme provides numerous opportunities. Students in the taxes and business industries might choose from a variety of employment titles. Higher education and specialties are possible, resulting in a higher average wage for students. In India, many government institutions employ B.Com Taxation graduates in a variety of positions. The majority of recruiting decisions are made based on an entrance exam, which is followed by an interview for graduates. The average pay ranges between INR 2 and 6 LPA. Public Sector Banks like RBI, SBI, UPSC Civil Services, Indian Railways, and other key government companies employ B.Com Taxation graduates.

Private Jobs for B.Com Taxation Graduates

B.Com Taxation graduates have a lot of options in the private sector. A taxation beginner’s pay will be in the range of INR 1.2 to 5 LPA. Private positions are accessible in organizations’ finance, accounting, banking, commerce, human resources, and administrative divisions. Students can immediately begin working or pursue further education after completing the course, depending on their talents and interests.

Read About Our More Courses:

M. Pharm (Master in Pharmacy) – A Complete Guide

Electro Homeopathy: Course, Career & Job Prospects

Diploma in Health & Sanitary Inspection

Diploma in Acupuncture – A Step by Step Guidance